This is an important distinction, because the current proxy token (worthless if the single point of failure Coinmat is hacked) are settled, not the actual crypto currency. This is the same as a centralized exchange moving values in database, only values are recorded on the waves blockchain. Only Waves and the tokens created in waves are fully decentralized.

As I stated previously if everyone runs a matcher/order book with a gateway, It’s just multiple independent centralized exchanges recorded on a blockchain. There’s no guarantee they’ll interact with each other and accept each others proxy tokens. This is a lot like problems of exchange faced by fiat currencies today, which block chain has been trying to solve, seems like Waves has just recreated the flawed fiat ecosystem on the Waves blockchain.

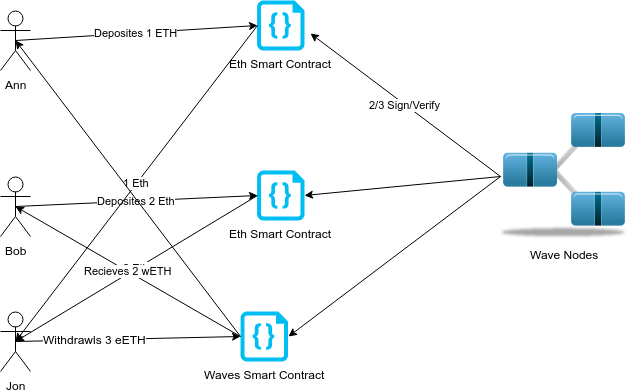

What I’m suggesting is reducing the single point of failure at a gateways by introducing an ecosystem that allows multiple gateways to deposit and withdrawal the same proxy token. Or better the witnessing and transacting of proxy tokens could become a function of full nodes. This could be done using smart contracts. If user A sends Eth to a public address controlled by a multiparty (all full nodes) smart contract, once witnessed by X (2/3) nodes the proxy token is issued by the smart contract. Vise versa for withdrawals. Slashing conditions could apply for bad actors.

I’m not sure how you would transition from coinmat issuing the verified tokens to a smart contract ecosystem? I suppose you could just launch it, and waves could unverify the coinmat issued tokens, and we hope coinmat has been a good actor and everyone can transfer the tokens out.

A couple issues arise including, the hardness of smart contracts, and a centralized matching service. The is also based on smart contracts being bullet proof. If smart contracts are cracked, theoretically you would burn the proxy token on a 1:1 ratio on the issuing wallet, and proxy token’s value against the official token would drop. Issues and the single point of failure of a centralized matching service would still need to be addressed, but perhaps “matching a service” is a suitable compromise of centralization for speed, until blockchain latency and nodes synchronization can be scaled sufficiently.

Well not a perfect solution, multiple smart contracts are more secure than a single gateway. Smart contracts as a means of introducing proxy tokens is fundamentally more in line with DEX and the ideology decentralization as related to cryptocurrency.